Have you ever wondered why the Jewish community—despite being a small percentage of the world’s population—appears disproportionately represented among global wealth creators and enduring business families?

This is not coincidence. It is the outcome of a capital stewardship system refined over more than 3,000 years, commonly referred to as “The Rule of Thirds.”

This principle is not about speculation. It is about survival, continuity, and multi-generational stability.

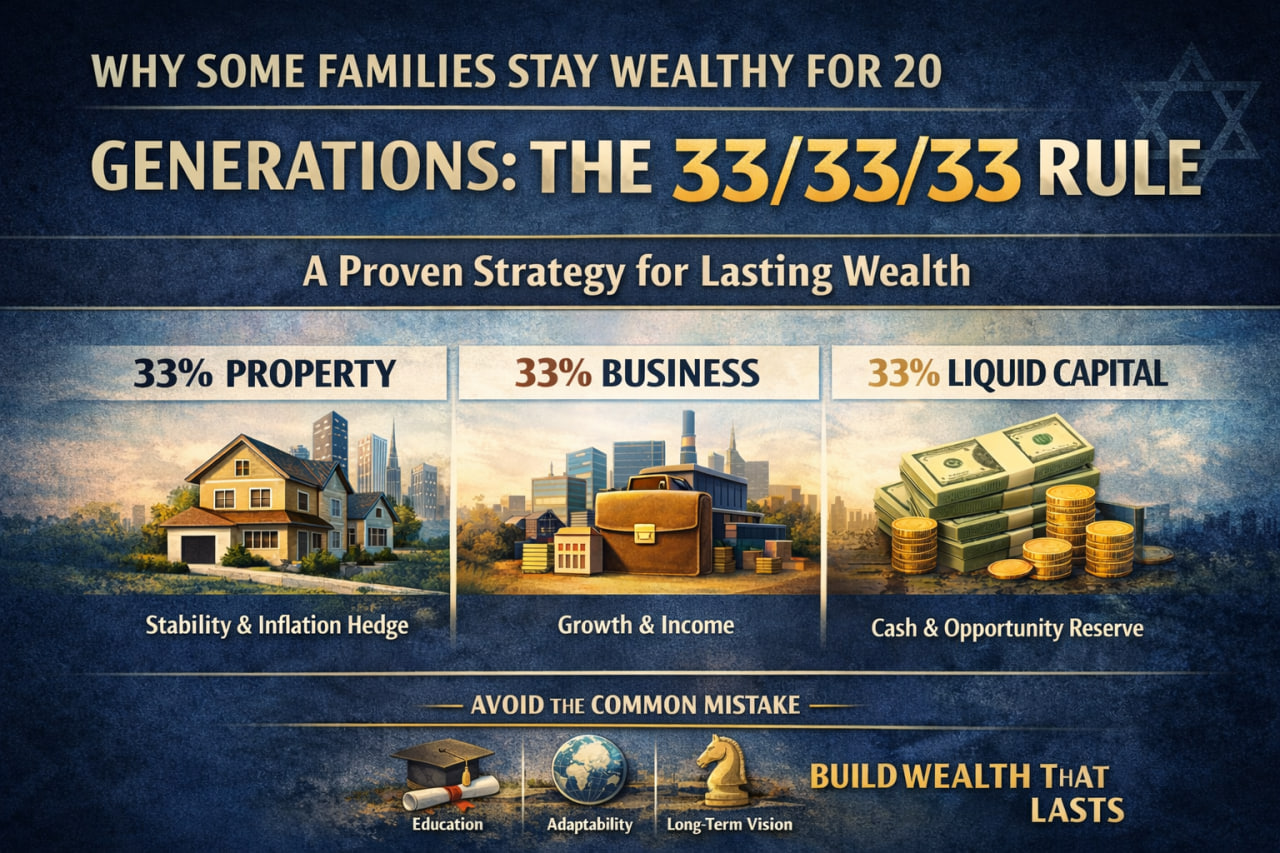

The Core Principle: Divide Wealth into Three Equal Parts

1/3 in Land & Property

Real estate provides stability, inflation protection, and permanence. Land cannot be printed, diluted, or easily erased. Over long cycles, property preserves purchasing power and anchors family wealth during political or economic turbulence.

1/3 in Business & Trade

Capital deployed into business creates active income and compounding growth. This portion rewards skill, innovation, and adaptability. It is where wealth expands—not just survives.

1/3 in Liquid Capital

This is the most overlooked pillar in modern investing.

Liquid capital (cash or assets convertible within 30 days) is not idle money. It is strategic optionality:

-

Protection during economic shocks

-

Ability to seize distressed or time-sensitive opportunities

-

Freedom from forced selling during downturns

Liquidity equals power during chaos.

The Modern Mistake

Most people today allocate 70–90% of their capital into a single asset class—often property or a single business—while neglecting liquidity.

When markets decline:

-

Cash-poor investors panic

-

Assets are sold at discounted prices

-

Wealth transfers from the impatient to the prepared

By contrast, families who maintain balance—what ancient wisdom attributes to King Solomon’s approach—survive wars, recessions, and systemic resets.

This framework is not purely financial. It is deeply philosophical.

Jewish families consistently prioritize education, because knowledge is the only asset that cannot be confiscated. Skills, reasoning, and literacy travel across borders and generations.

The Rule of Thirds teaches:

-

Discipline over greed

-

Structure over emotion

-

Stewardship over consumption

It creates psychological freedom from fear and excess.

If your goal is long-term, generational wealth, the question is not how fast you grow—but how well you balance.

Re-examine your capital structure:

-

Property for stability

-

Business for growth

-

Liquidity for protection and opportunity

Wealth that lasts 20 generations is not built on luck.

It is built on balance, patience, and intelligent stewardship.

Join The Discussion