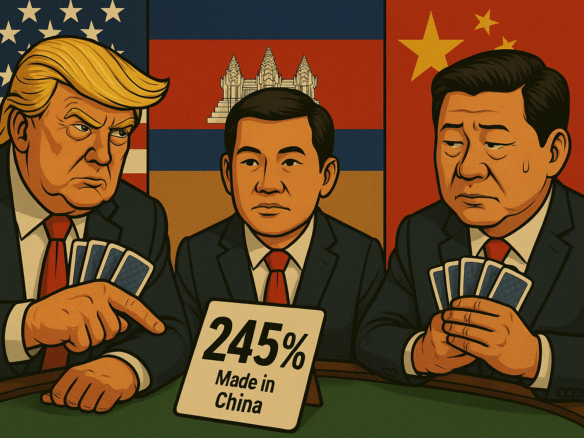

Recent geopolitical tensions between Cambodia and Thailand have triggered a consumer-level boycott of Thai products—long a dominant supplier in Cambodia’s everyday consumption landscape.

While conflict is never desirable, history shows that supply disruption often accelerates structural change.

What we are witnessing is not merely a short-term reaction—but the early signal of a local production reset.

This moment deserves sober analysis, not emotion.

A Structural Gap Has Opened in Cambodia’s Consumer Economy

For decades, Cambodia relied heavily on imported fast-moving consumer goods (FMCG), food products, household items, and light industrial goods—many originating from Thailand.

The sudden withdrawal or rejection of these products has created:

• Shelf gaps

• Supply inconsistency

• Rising import risk

• A shift in consumer psychology toward “local trust”

This is how domestic industries are born.

Why This Moment Is Different From the Past

Cambodia today is not the Cambodia of 10–15 years ago.

Three conditions now align:

1. Demand Exists First

Consumers are not being “educated” to buy local.

They are actively seeking alternatives.

2. Capital Is Regionally Mobile

ASEAN investors, Chinese operators, and regional family offices are already seeking lower-risk production bases with domestic absorption—not export-only dependency.

3. Government Alignment Is Likely

When domestic production strengthens national resilience, policy tailwinds follow—often quietly, but decisively.

This is the early phase of a substitution economy.

The Real Opportunity: Not Products, but Platforms

This is not about creating “another brand.”

The real opportunity lies in building:

• Local manufacturing platforms

• Brand ecosystems with national loyalty

• Contract production hubs

• Distribution-first consumer systems

Factories matter—but brands matter more.

The winners will not be those who rush.

The winners will be those who structure correctly.

Who Should Pay Attention Now

This window is particularly relevant for:

• Cambodian entrepreneurs upgrading from trading → production

• Regional operators relocating light manufacturing

• Investors seeking domestic-demand-anchored assets

• Brand builders with long holding periods

• Family capital seeking resilience, not speculation

This is not for short-term traders.

Capital Strategy Over Hype

Every cycle offers two paths:

- Emotional reaction → rushed decisions

- Strategic positioning → compounding advantage

Cambodia is entering a phase where local production, national identity, and capital efficiency intersect.

Those who understand cycles, not headlines, will build the next generation of Cambodian consumer champions.

This is not a call to boycott.

This is not a call to speculate.

This is a call to think structurally.

Cambodia’s long-term strength will not be measured by imports replaced—but by industries built.

Those who enter early with discipline will shape the next decade.

Join The Discussion